Putting aside first-tier Chinese cities: lower-tier cities’ potential

Today, China is the biggest market in the world. The size of its area and its population are both growth and opportunities factors for any enterprise that wishes to develop in Asia. However, first-tier cities such as Beijing or Shanghai do not imply the meaning of growth potential anymore. The increase of living standards has also been followed by the increase of living costs. Rentals and education are the main expenses for Chinese households.

Then, what are the new growth centers and what are their new consumption characteristics?

The new face of urbanization

More than thirty Chinese cities have a population that exceeds New York’s one. Even so, cities like Chengdu or Guangzhou that harbor populations of more than 10 million people are still not well known from foreign enterprises. Yet, they are large distribution markets.

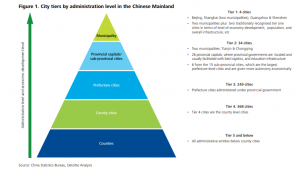

Chinese towns are ranked according to a system of levels or tiers. Even though this system is unofficial, it still gives a vision on the diversity of the country. In this way, the first-tier cities are Beijing, Shanghai, Guangzhou and Shenzhen. In terms of population and infrastructures, as well as economically, those cities are indeed the most developed.

Following, the two municipalities of Tianjin and Chongqing, as well as 26 provincial capitals, are ranked as second-tier cities. Then, the third-tier is composed of 249 cities. Finally, the fourth-tier is composed of 368 cities.

Even though many enterprises are only interested in first-tier cities and sometimes second-tier ones, cities of third and fourth-tier are also emerging as important consumption poles, especially through and thanks to ecommerce. Indeed, in January 2016, when first and second-tier cities were harboring 183 million digital buyers (people buying products online), third and fourth-tier cities were already harboring 257 million ones. Furthermore, in 2016, the Internet coverage reached 89% in third and fourth-tier cities.

Taobao succeeded to take advantage of the Internet deployment. Taobao villages 淘宝村 appeared in 2009, mainly in rural areas. They are clusters of distribution that sell local products on Alibaba’s platform.

This can be explained by the increase of incomes in lower-rank cities. According to Morgan Stanley’s study, disposable income in third and fourth-tier cities matches 55% of first and second-tier cities household’s income. By 2030, those incomes match are expected to reach 64%.

Evolving hobbies and ambitions

The increase of incomes in lower-tier cities also means a change in their consumption habits. Moreover, many millennials (individuals that are born between 1980 and 2000) are going back to their homeland in order to enjoy lower real estate expenses, lower life costs and better quality of life. Usually, they went through standard education, have a stable professional occupation and have sufficient income.

Those consumers are also enjoying a better purchasing power. In addition, a large majority of them are ready to pay for online entertainments rather than spending their income in night clubs and gyms. No matter if it is about live streaming, video games, music or reading, they can access to those different types of entertainments through their mobile phone. Otherwise, those buyers are spending in healthcare or material goods such as cars. For example, more than 32% of Cadillac’s (General Motors) purchases in the first trimester of 2018 were from lower-tier cities and 45% of the buyers were between 25 and 34 years old.

For the moment, their consumption level does not reach Beijing or Shanghai consumers’ one. Nevertheless, those consumers are already paying attention to products’ quality and are gradually welcoming luxury products. Thereby, Louis Vuitton opened shops in third-tier cities (Kunming, Shijiazhuang and Zhengzhou). Priority is still given to high purchasing power consumers. Moreover, luxury shops in those small cities are often selling items from the previous collection. Still, the opening of such kind of luxury shops in lower-tier cities is a sign of future local development opportunities.

A different marketing according to industries and cities

Even though lower-tier cities can be considered as growth vectors, the promoting of a product in Beijing will not be the same as it would be in Kunming. Indeed, not all the products and brands can suit lower-tier cities. Thus, promoting luxury products and opening luxury shops in small towns can lead to an obliteration of a brand’s prestige for consumers of first-tier cities. For example, while Burberry enjoyed the welcoming of second and third-tier markets, its brand has lost value in the eyes of first-tier consumers. Reason was that they lost the privilege of exclusivity.

In the luxury sector, still, several brands started to promote their products of the video sharing application Douyin 抖音 (also known as Tik Tok in the West) that was created in 2016. However, the fast development of this application through the whole country implied that most of the users were located in the third and fourth-tier cities. Thus, it became less appealing for some brands to invest in this tool for digital communication.

In the other hand, an application of ecommerce called Pinduoduo (拼多多) focuses mostly on buyers of middle-size cities. Pinduoduo (拼多多) allows its users to enjoy cheaper goods thanks to group purchases. Used together with Wechat (微信), its core is about using one’s network to obtain advantageous prices on daily life products (toilet paper, pencils, etc.).

Urbanization’s level should reach 60% by 2020 and it will be followed by the increase of purchasing power. The Chinese market is composed of several layers, with submarkets having their own characteristics. Even though the middle class of second and third-tier cities tends to grow rapidly, it is primordial to study thoroughly the targeted communities before promoting any product. The choice of the platform, the city and the type of marketing is important. Thus, it is necessary to assess the evolution of a shifting, more connected and always younger Chinese market.